This Bill Moyers interview with Simon Johnson and Michael Perino about the Pecora Commission and its relevance for today is very very good, and anyone interested in the financial crisis who also has the slightest bit of interest in history should check it out. (A transcript is helpfully provided for those who don’t want to sit through an hour.)

At one point Johnson and Perino got into a bit of a disagreement over whether financial products should be labled like food products:

SIMON JOHNSON: Let me put it this way, Bill, 150 years ago, I could have stood outside your studio on the street of New York and sold anything in a bottle and called it a medicine, okay? Quack medicine is what it was called. And it could have been, you know, good for you or bad offer you or it could have killed you. And it would– I could have done it. I would have done it, right? People did it.

Now that’s illegal. You go to prison. There are serious criminal penalties for selling things that you claim are medicine that are– that are not medicine. And obviously we argue even about very fine distinctions of how good is this for you under what circumstances? The same transformation will take place, I am sure, over the next 150 years for financial products. I’d like to bring it forward a little bit and have it happen in the next couple of years.

MICHAEL PERINO: I’m not–

SIMON JOHNSON: I think that change of view of, you know, to what extent can the consumer decide for himself or herself, to what extent do you need protection, guidance, very strong labels on products? I think that we’ve changed many ways we think about things as we modernized our economy looking over the past century. But the financial products, not so much.

MICHAEL PERINO: If you look back at the history, the first securities regulations were not federal regulation but state regulation. They were called the “blue sky laws.” And the “blue sky laws” were exactly the model you’re talking about. The “blue sky laws” were what were called merit regulation. And the idea behind merit regulation is that there will be a state regulator who will look at the quality of these securities and will determine whether they are appropriate or not to sell to investors in that state.

It’s a model that federal securities regulation rejected because the view was, you know, do we really want to be in a position where some bureaucrat is deciding what’s an appropriate risk for an investor to take? Or are we better off with the progressive model, a model that Brandeis wrote about in his famous book called “Other People’s Money” where he says, No, we don’t need to be regulating the substance of this. What we need to rely on, in his phrase, is sunlight, electric light, he says, is the best policeman.

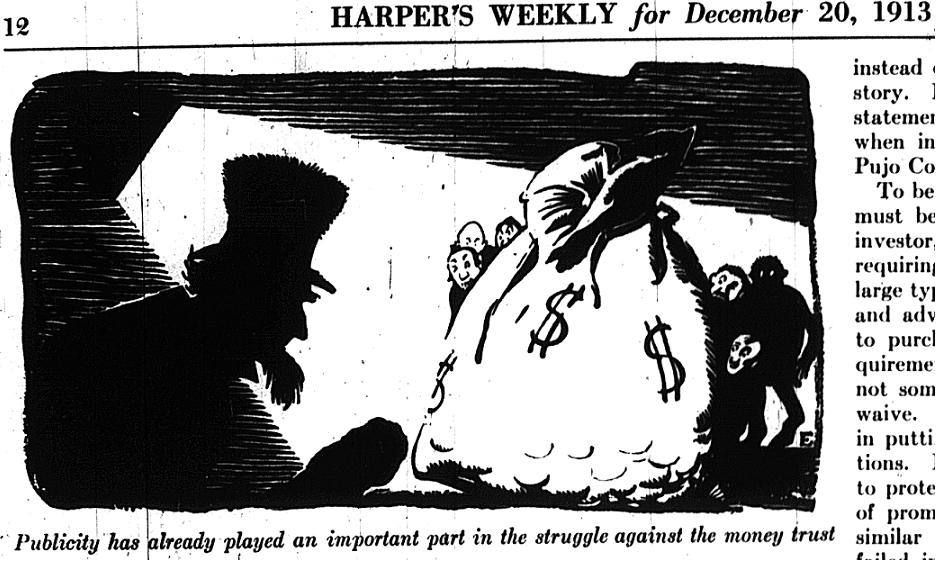

It’s too bad that Johnson didn’t point out that Perino, who’s doing a biography of Pecora and presumably has gotten into the relevant history – Other People’s Money was reprinted around the time of the Pecora hearings and first came out in 1913-4 following a similar, but less famous, set of hearings on banking conducted by the Pujo Committee in 1912 – apparently missed the part later in the same chapter that the “sunlight” quote is drawn from where Brandeis wrote (under “Publicity as a Remedy”):

Now the law should not undertake (except incidentally in connection with railroads and public-service corporations) to fix bankers’ profits. And it should not seek to prevent investors from making bad bargains. But it is now recognized in the simplest merchandising, that there should be full disclosures. The archaic doctrine of caveat emptor is vanishing. The law has begun to require publicity in aid of fair dealing. The Federal Pure Food Law does not guarantee quality or prices; but it helps the buyer to judge of quality by requiring disclosure of ingredients. Among the most important facts to be learned for determining the real value of a security is the amount of water it contains. And any excessive amount paid to the banker for marketing a security is water. Require a full disclosure to the investor of the amount of commissions and profits paid; and not only will investors be put on their guard, but bankers’ compensation will tend to adjust itself automatically to what is fair and reasonable. Excessive commissions—this form of unjustly acquired wealth—will in large part cease.

In other words, the clock has already been running for nearly a century on the effort to label financial products. The question isn’t whether we’ll get it in a few years or in a century; it’s whether it will take another century.