This Bill Moyers interview with Simon Johnson and Michael Perino about the Pecora Commission and its relevance for today is very very good, and anyone interested in the financial crisis who also has the slightest bit of interest in history should check it out. (A transcript is helpfully provided for those who don’t want to sit through an hour.)

At one point Johnson and Perino got into a bit of a disagreement over whether financial products should be labled like food products:

SIMON JOHNSON: Let me put it this way, Bill, 150 years ago, I could have stood outside your studio on the street of New York and sold anything in a bottle and called it a medicine, okay? Quack medicine is what it was called. And it could have been, you know, good for you or bad offer you or it could have killed you. And it would– I could have done it. I would have done it, right? People did it.

Now that’s illegal. You go to prison. There are serious criminal penalties for selling things that you claim are medicine that are– that are not medicine. And obviously we argue even about very fine distinctions of how good is this for you under what circumstances? The same transformation will take place, I am sure, over the next 150 years for financial products. I’d like to bring it forward a little bit and have it happen in the next couple of years.

MICHAEL PERINO: I’m not–

SIMON JOHNSON: I think that change of view of, you know, to what extent can the consumer decide for himself or herself, to what extent do you need protection, guidance, very strong labels on products? I think that we’ve changed many ways we think about things as we modernized our economy looking over the past century. But the financial products, not so much.

MICHAEL PERINO: If you look back at the history, the first securities regulations were not federal regulation but state regulation. They were called the “blue sky laws.” And the “blue sky laws” were exactly the model you’re talking about. The “blue sky laws” were what were called merit regulation. And the idea behind merit regulation is that there will be a state regulator who will look at the quality of these securities and will determine whether they are appropriate or not to sell to investors in that state.

It’s a model that federal securities regulation rejected because the view was, you know, do we really want to be in a position where some bureaucrat is deciding what’s an appropriate risk for an investor to take? Or are we better off with the progressive model, a model that Brandeis wrote about in his famous book called “Other People’s Money” where he says, No, we don’t need to be regulating the substance of this. What we need to rely on, in his phrase, is sunlight, electric light, he says, is the best policeman.

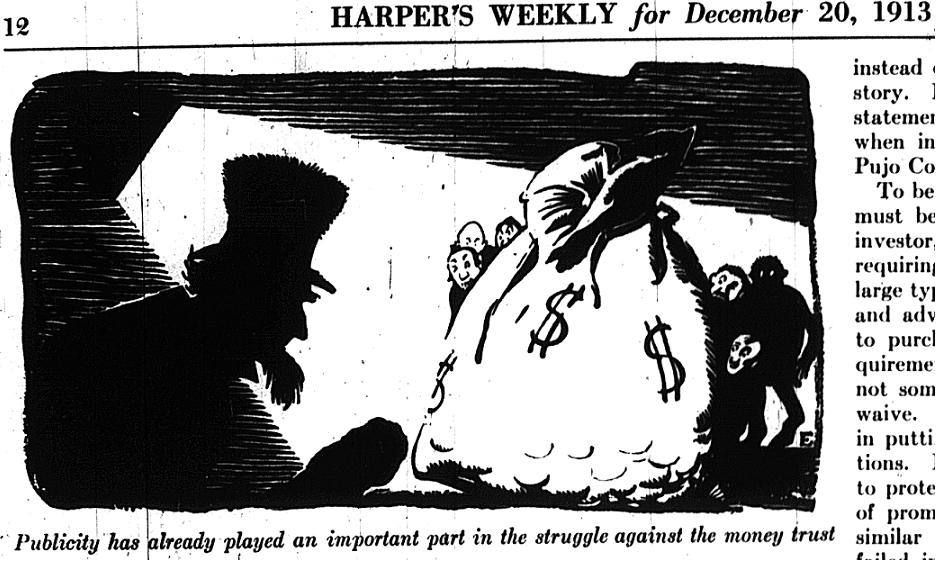

It’s too bad that Johnson didn’t point out that Perino, who’s doing a biography of Pecora and presumably has gotten into the relevant history – Other People’s Money was reprinted around the time of the Pecora hearings and first came out in 1913-4 following a similar, but less famous, set of hearings on banking conducted by the Pujo Committee in 1912 – apparently missed the part later in the same chapter that the “sunlight” quote is drawn from where Brandeis wrote (under “Publicity as a Remedy”):

Now the law should not undertake (except incidentally in connection with railroads and public-service corporations) to fix bankers’ profits. And it should not seek to prevent investors from making bad bargains. But it is now recognized in the simplest merchandising, that there should be full disclosures. The archaic doctrine of caveat emptor is vanishing. The law has begun to require publicity in aid of fair dealing. The Federal Pure Food Law does not guarantee quality or prices; but it helps the buyer to judge of quality by requiring disclosure of ingredients. Among the most important facts to be learned for determining the real value of a security is the amount of water it contains. And any excessive amount paid to the banker for marketing a security is water. Require a full disclosure to the investor of the amount of commissions and profits paid; and not only will investors be put on their guard, but bankers’ compensation will tend to adjust itself automatically to what is fair and reasonable. Excessive commissions—this form of unjustly acquired wealth—will in large part cease.

In other words, the clock has already been running for nearly a century on the effort to label financial products. The question isn’t whether we’ll get it in a few years or in a century; it’s whether it will take another century.

From that much-recommended Simon Johnson article on the financial crisis:

The great wealth that the financial sector created and concentrated gave bankers enormous political weight—a weight not seen in the U.S. since the era of J.P. Morgan (the man). In that period, the banking panic of 1907 could be stopped only by coordination among private-sector bankers: no government entity was able to offer an effective response. But that first age of banking oligarchs came to an end with the passage of significant banking regulation in response to the Great Depression; the reemergence of an American financial oligarchy is quite recent.

It just so happens that I’ve been digging around a bit in the 1900s (the “aughts”, I guess). Here’s how Michael McGerr describes the events of 1907 in A Fierce Discontent: The Rise and Fall of the Progressive Movement in America, 1870-1920, pages 178-180. I’ve decided to quote extensively more than paraphrase since McGerr lays it out quite nicely and the details are important:

In October, a worldwide shortage of credit mercilessly exposed the limitations of the nation’s banking and currency systems. A collapse of copper prices raised fears about banks and trust companies heavily involved in the mining industry. On October 22, frightened depositors made a run on the Knickerbocker Trust Company, which had extensive involvement with copper: the company closed the next day. The terror spread… As the banks and trust companies of New York struggled to meet their obligations, the whole banking system of the country seemed suddenly in peril. Morgan, Stillman, and the rest of the great money men labored to hold things together. John D. Rockefeller publicly pledged half his possessions to the cause. With millions of Rockefeller’s dollars on deposit, the National City Bank played a key role in the crisis. “They always come to Uncle John when there is trouble,” Rockefeller bragged. Even so, the federal government had to step in. Roosevelt’s secretary of the treasury, George Cortelyou, provided the banks with $37 million and then $31 million. Still the run continued; the banks stopped payments to depositors….

As the Panic entered a second week and the Trust Company of America became the focus of worry, Roosevelt was drawn into a dubious deal. The money to save the company would have to come from the financial markets, but they were supposedly jeopardized by the weakness of Moore and Schley, a firm of underwriters. The fate of Moore and Schley, in turn, depended on the sale of its shares in the Tennessee Coal and Iron Company. With money from those shares, Moore and Schley would survive, the stock market would stay high, and firms could then afford to put up the money to save the Trust Company of America. But who would buy the shares in Tennessee Coal and Iron? United States Steel was willing–if the government would agree not to take the acquisition to court under the Sherman Act. The leaders of the steel corporation, Elbridge Gary and Henry Clay Frick, met with the President on November 4 to explain the firm’s noble proposal. They did not dwell on the fact that this bargain-basement acquisition would give United States Steel a powerful hold on the Southern market. Roosevelt indicated he had no objection to the deal, which promptly went forward.

Through November, the government sold bonds to banks on easy terms; thus fortified, the banks rode out the Panic. Confidence returned, the credit shortage diminished, workers kept their jobs–the country seemed fine. Nevertheless, the Panic of 1907 had changed things.

McGerr goes on to point out that while the financiers had found themselves in a weak position, forced to turn to the federal government for help, the resolution of the crisis demonstrated their continuing strength:

The government had had no choice but to help the “financial captains.” Roosevelt had accepted the Tennessee Coal and Iron deal. In November, Elbridge Gary began to bring together the leaders of the steel industry to discuss matters of common concern; Washington tolerated these “Gary dinners,” an open display of anticompetitive collusion. Further, the great industrial firms showed real strength in the uncertain economic climate. Instead of renewing the price-cutting wars of the 1890s, U.S. Steel and other companies maintained their prices after the Panic.

Roosevelt, McGerr writes, responded to the crisis by calling for more regulation, including allowing the federal government to examine corporations’ books and giving the Interstate Commerce Commission the power “to regulate issues of railroad securities, to determine the physical value of railway lines, and even to set railway rates.” None of that happened during his presidency:

Instead, he found himself trapped in an argument about responsibility for the Panic. Opponents claimed that the administration’s program in general and the judgment against Standard Oil in particular had precipitated the crisis. “The runaway policy of the present Administration can have but one result,” John D. Rockefeller told a reporter. “It means disaster to the country, financial depression, and chaos.” Even Americans receptive to antitrust and regulation wondered whether too much government interference inhibited economic growth.